In case you didn’t know, yesterday was [‘bitcoin pizza day.’] It marked 13 years to the day that Laszlo Hanyecz, a Floridian programmer, bought two Papa John’s pizzas for 10,000 Bitcoin.

Today, those pizzas would be valued at roughly $270 million. Talk about expensive taste.

Hanyecz’s pizza purchase was one of the first Bitcoin transactions and came the year after the cryptocurrency’s mysterious inception in 2009.

Back then, there wasn’t much of a regulatory landscape in the crypto world. After all, Bitcoin was largely an unknown, trading at $0.3 a coin and not posing any real or credible threat to the financial system (in the eyes of politicians).

Fast forward to today, the regulatory landscape in the crypto world is understandably far more prominent — although, in truth, it has failed to keep pace with the growth in popularity and ubiquity of cryptocurrency in general.

The current regulatory landscape is largely muddled and confused. Whilst policymakers have implemented some crypto regulations, they are constantly changing and are not unified under a recognised framework.

Let’s look at the US, for example.

As early as 2013, Bitcoin was considered a virtual currency and payment system by the US Treasury. It was then considered a commodity in 2014, and then in 2021, Bitcoin was treated as physical cash by the US Congress.

In part, this is due to the several different regulators operating in the US, with agencies such as the Securities and Exchange Commission (SEC), Commodity Futures Trading Commission and the Treasury all having conflicting views.

[According to Paul Kuveke], the operating officer at US crypto firm Mintbase, this ambiguity led to expensive operating costs (due to consultations with lawyers), doubts and the realisation that operating overseas could be more profitable.

Even the US’ largest crypto exchange Coinbase [revealed it is considering leaving the US] if the regulatory landscape doesn’t become clearer.

The UK crypto regulatory landscape also faces uncertainties.

Last April, the UK government [announced plans] to make the UK a global technology hub, which would include regulating stablecoins as a recognised form of payment.

However, their stance appears to have changed since last April, with the [UK’s House of Commons Treasury Committee] recommending the UK government to regulate crypto trading as gambling.

This clearly shows the lack of understanding toward the use case of crypto amongst policymakers and could be masking fears they have about the ‘threat’ of this new money system poses to existing fiat currency systems.

The regulatory landscape in Asia also remains fragmented.

On one side of the spectrum, you have China, which has a blanket ban on all crypto-trading related activities, from mining through to trading.

On the other, you have Japan, which approved Bitcoin as a type of money and is home to one of the world’s most progressive crypto regulatory climates.

India lies somewhere in the middle. In 2016, it imposed a complete ban on all crypto-related activities. Nowadays, there is no central authority that regulates the use of cryptocurrencies, although a [30% tax on digital assets] is now in play in India.

Whilst the US, UK and Asia continue to face crypto regulatory uncertainties, the European Union is pressing ahead.

On 17 May 2023, the EU approved a comprehensive set of regulations (called Markets in crypto assets regulation, MiCA) that will for the first time, give a regulatory framework for how crypto is to be regulated.

In particular, MiCA will require issuers of cryptocurrencies, exchanges, and wallet providers to register and authorise their services, meet security standards and comply with money-laundering laws.

MiCA is expected to come into effect by mid-2024.

Financeology thinks that this move from the EU is hugely positive and will go a long way in re-building trust and transparency after a tumultuous year in the crypto world. It also highlights the viable and undeniable co-existence between fiat and cryptocurrencies.

Of course, some regulation is necessary for the crypto world to thrive. The recent slew of bankruptcies highlighted by the collapse of FTX, BlockFi and Celsius re-iterate the need for consumer protections in an inherently volatile industry.

Regulations may also weed out some of the ‘bad actors’ whilst also providing protective measures for crypto users.

Finding the right balance will come from the regulators, who – as shown – are still failing to understand crypto and its potential and the benefits it can provide in terms of efficiency and security.

The key for the industry will be regulations that foster the growth of the global crypto ecosystem without stifling innovation.

The EU MiCA framework may have set the global precedent for crypto regulation that now, and injected fresh momentum into the regulatory landscape.

On 23 May 2023, Iosco, the umbrella group for global market regulators, [published guidelines] on how regulators could toughen standards in terms of disclosure rules and governance for crypto companies in their respective jurisdictions.

Iosco secretary-general Martin Moloney stated:

“What we would say to jurisdictions is just push ahead. They’ve all got different legal frameworks. Just push ahead, do it to this standard as quickly as you can … it’s not helpful for anyone to hold back at this point.”

To be clear, Iosco doesn’t have the power to compel regulators to adopt the rules, which covers 130 countries and 95% of global financial markets.

Nevertheless, the past week feels like a watershed moment for global crypto regulation.

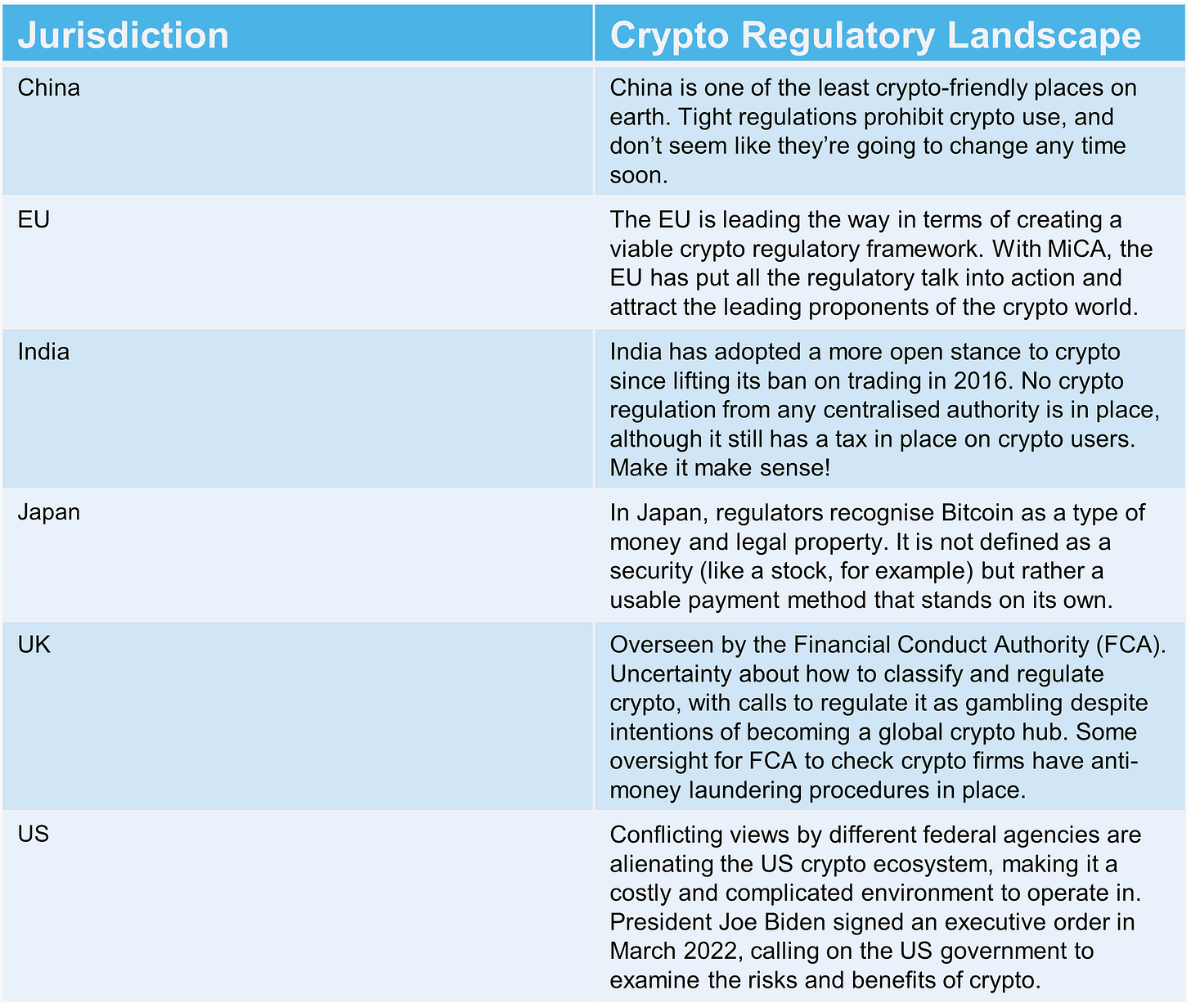

For good measure, here’s a more detailed summary of how the crypto regulatory landscapes in the world’s major economies currently line up:

Whilst ambiguities in regulation remain, the EU MiCA rules could set a standard for cryptocurrencies regulation that garners first-mover advantage over US policymaking, which could then undermine governance of the crypto marketplace within US borders as investors look for EU-style standards in an environment in which domestic regulators typically work to set precedents that are copy / pasted globally. In fact, [according to Triple-A] the US crypto marketplace is home to 46 million users in various coins, with the second-closest country (India) having 27 million users.

In many ways, this could lead to fresh innovation in the crypto world and help take the industry to the next level in terms of global adoption and awareness.

At the same time, the improving regulatory backdrop could give the crypto industry the direction it so desperately needs.